Registering as self-employed with HMRC involves a crucial step: acquiring your Unique Taxpayer Reference (UTR) number. This unique identifier is essential for filing your tax returns and ensuring smooth communication with the authorities. Don't fret! Obtaining your UTR is a relatively straightforward process. Comply with these simple steps outlined below to secure your UTR number swiftly and efficiently.

- First things off, visit the official HMRC website at gov.uk/ utr .

- Start a an online account if you don't already have one.

- Submit the required information accurately and completely, including your personal information.

- Upon successful submission, HMRC will examine your application.

- You are going to receive your UTR number via email within a few days.

Keep your UTR number safe and readily available for all future interactions with HMRC. Good luck!

Grasping UTR Numbers and Their Importance for Tax Filing

When it comes to tax filing in numerous countries, a key piece of information you'll demand is your Unique Taxpayer Reference number, often abbreviated as a UTR. This unique identifier is assigned through the relevant tax authority and acts as a way to distinguish individual taxpayers for operational purposes. Understanding your UTR number and its significance is crucial for ensuring accurate and efficient tax filing.

Failure to provide your UTR number with your tax forms here can lead to delays, penalties, or even rejection of your filing. Therefore, it's essential to keep your UTR number readily handy.

- That are some key reasons why understanding your UTR number is so important:

- Accurate Tax Processing: Your UTR helps ensure that your tax information is correctly matched to your record.

- Organized Communication: The tax authority can use your UTR to promptly communicate with you about your tax obligations and any updates.

- Claiming Benefits: Your UTR may be essential when applying for certain tax benefits.

Secure Your UTR Number with HMRC Online

To start your self-employment journey in the United Kingdom, you'll need to apply for a Unique Taxpayer Reference (UTR) number from Her Majesty's Revenue and Customs (HMRC). Fortunately, the process of applying for your UTR is straightforward. You can entirely conduct the application online through the HMRC website.

- Initially, you'll need to gather your personal information, including your name, address, and National Insurance number.

- Then, navigate to the HMRC website and locate the UTR application form.

- Carefully fill out the form with your correct details.

- Upon submitting the form, you'll receive a confirmation email from HMRC.

It usually takes some days to obtain your UTR number. Once you have it, keep it protected as you'll need it for all future fiscal interactions with HMRC.

HMRC UTR Registration: What You Need to Know

To begin a self-employment journey in the UK, you'll need to register for a Unique Taxpayer Reference (UTR) with Her Majesty's Revenue and Customs (HMRC). This numerical identifier is essential for submitting your tax returns and settling any income tax owed.

- Make sure you meet the criteria for UTR registration by checking HMRC's guidance online.

- Compile the necessary information, such as your complete name, personal information, and National Insurance number.

- Apply for your UTR online through the HMRC website. You'll need to create an account if you don't already have one.

Once registered, you'll receive your UTR number and instructions on how to file your tax returns. It's important to store your UTR number safe as you'll need it for all future interactions with HMRC.

Locate Your Existing HMRC UTR Number

Your Unique Taxpayer Reference (UTR) identifier is a vital fragment of information required for interacting with the Her Majesty's Revenue and Customs (HMRC). Should you you've misplaced your UTR number, don't panic. There are several straightforward methods to retrieve your existing HMRC UTR number.

- Begin by checking any correspondence from HMRC, such as tax assessments. Your UTR will likely be presented on these documents.

- Alternatively, you can access your UTR through your personal account on the HMRC website.

- If not, contact HMRC directly via their helpline or correspondence. They will be able to authenticate your identity and provide your UTR code.

Guarantee you have all necessary documents readily available when contacting HMRC, as this will accelerate the process.

Encountering Issues with Your HMRC UTR Application

Applying for a Unique Taxpayer Reference (UTR) through HMRC can sometimes throw up challenges. If you're experiencing issues with your application, don't worry. Here are some common problems and possible solutions to help overcome them.

- One typical issue is an error message indicating that your application is incomplete. Carefully review all the required boxes to ensure you've provided all necessary information.

- Network issues can also interrupt your application process. Try refreshing your browser or connecting HMRC's website using a different connection.

- If you've submitted your application and haven't received a confirmation, it's best to reach out to HMRC customer assistance. They can look into the status of your application and assist you ahead.

Patrick Renna Then & Now!

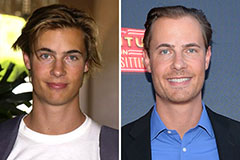

Patrick Renna Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!